Nab's New Islamic Finance Providing Backs Bodon Houses Enlargement

페이지 정보

본문

Australia's finance sector is tapping into the Islamic market, with one of the country's biggest lenders launching a Sharia-compliant loan. We have a dedicated group of bankers who understand the unique needs of Muslim companies and neighborhood teams. We are the only major bank in Australia providing a Shariah compliant solution to help you develop your corporation.

Understanding Fixed Profit Charges In Halal Loans

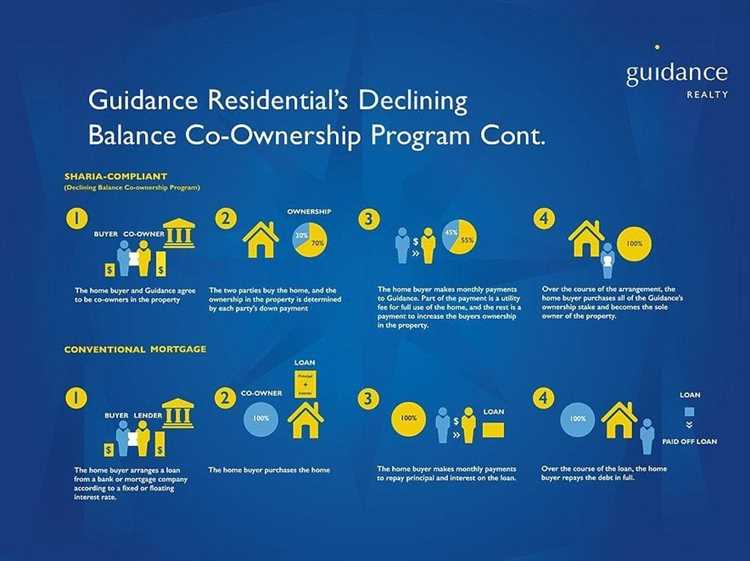

The halal mortgage dealer facilitates this process, guaranteeing that each one transactions are carried out in accordance with Islamic teachings. Australian residents and traders on the lookout for moral and sharia-compliant property financing choices can profit from the companies offered by halal finance suppliers like Halal loans. Sharia loans play an important role in home finance by providing an alternative to typical mortgages while adhering to Islamic ideas. These loans observe the framework of Halal Mortgage inside the Islamic religion, guaranteeing clients should purchase properties with out compromising their beliefs.

Residential Loans

Interest-free financing has turn into an more and more popular choice in fashionable finance, offering people and businesses the chance to access funds with out incurring interest costs. Understanding the legal framework for Halal loans is important for people and companies who wish to have interaction in Islamic finance. Halal loans are governed by a set of principles and tips derived from Islamic law, often recognized as Shariah. Understanding the asset backing for Halal financing is crucial so as to comprehend the underlying ideas that govern Islamic financial transactions. Unlike standard finance which depends on interest-based borrowing and lending, Halal financ...

"Islamic finance" has taken off in current years, promising halal avenues to realize the "dream" of home ownership and far more. In this essential occasion, the core elements of Islamic finance with respect to its benefit to the neighborhood and its claims of Shariah compliance are analysed. At Credit Hub, we're committed to guide you thru a pathway to moral property possession that’s consistent with your values. We’re dedicated to helping you obtain your property investment objectives responsibly and with integrity.

For funding choices that help grow your wealth while being Islamically sound, MCCA has the right choices for you. Our phrases are competitive with one of the best finance options obtainable in the open market. Past efficiency information isn't a dependable indicator of future efficiency and Hejaz Financial Advisers doesn't guarantee the performance of any monetary merchandise. Any reference to past efficiency on this web site is intended to be for common illustrative purposes.

Halal loans are monetary merchandise that comply with Islamic principles, making them an appropriate option for religious Muslims. MCCA Group is the first and main supplier of Shariah compliant finance and investments in Australia. We demonstrate dedication and service to Australian Muslims by providing high quality financial solutions which are profitable, sustainable, convenient, and Shariah compliant.

A Sharia purchaser, in the realm of Halal Mortgage, is a person deeply committed to the ideas and teachings of Islam. Engaged in the home financing course of, a Sharia buyer aligns their actions with the provisions set forth by the mortgage system to ensure compliance with the Halal Mortgage theory. With a focus on the building societies and the property acquisition mannequin, a Sharia purchaser demonstrates a sound understanding of the finance terms while prioritizing the protection of their home ownership. By choosing Sharia home loans in Australia, they not only leverage rental finance and re-financing alternatives but in addition actively contribute to the expansion of Halal finance within the nation.

- As a financial system that's guided by principles rooted in Islamic law, it places a robust emphasis on fairness, justice, and social accountability.

- From these that meet the right requirements, the firm will put together promising portfolios to finest meet the monetary needs of their buyers.

- Australian buyers seeking halal loans can profit from partnering with a good halal loans provider that offers transparent and ethical financing solutions.

- A loan tenure refers back to the period inside which you're required to repay your loan in full.

- Halal loans suppliers, similar to Halal Loans, supply Islamic financing companies tailored to Australian residents looking for Shariah-compliant home financing options.

- However, the rise of social media has contributed to an elevated consciousness and vital development in sharia-compliant finance.

HSBC and Lloyds Bank within the UK are two examples of companies which have efficiently entered the riba-free market. However, institutions like these are turned off by the Australian laws which "stagnate growth", Mr Shehata stated. Muslims can participate in similar investment autos and money transfers as non-Muslims. Muslim communities all through the world use hawala for paperless financial interactions. Some banks might conduct it, but it is a good way to transfer cash without banks.

- 이전글baixar video do instagram 538 24.07.25

- 다음글Six Extra Cool Tools For बाइनरी विकल्प 24.07.25

댓글목록

등록된 댓글이 없습니다.